Content

The chart of accounts is therefore the foundation of the financial statements. Each of the expense accounts can be assigned numbers starting from 5000. Typically, when listing accounts in the chart of accounts, you should use a numbering system for easy identification. Small businesses commonly use three-digit numbers, while large businesses use four-digit numbers to allow room for additional numbers as the business grows. Companies often use the chart of accounts to organize their records by providing a complete list of all the accounts in the general ledger of the business. The chart makes it easy to prepare information for evaluating the financial performance of the company at any given time. Your chart of accounts allows you to get an overview of all the debts you owe to others—the company’s liabilities.

Banking Sector: Storm Clouds Are Gathering – Seeking Alpha

Banking Sector: Storm Clouds Are Gathering.

Posted: Sat, 18 Feb 2023 07:28:37 GMT [source]

It is hard for me to be critical because 90% of https://personal-accounting.org/ owners can probably relate to never having looked at their chart of accounts. Even many controllers and CFOs are weak on how to structure a robust chart of accounts that easily and plainly produces the financial information management wants to see.

Account descriptions

As the company grows, GAAP-based financials are needed for the banks, investors, and agencies like bonding companies. Often, GAAP-based financials are the end of the progression. Seven steps to building the perfect chart of accounts 1. Build the accounts for management, not for GAAP and tax purposes. Month end financial statements simply summarize and group the balances that are in the individual accounts at month end. It is quite common for financial reports to fall short of executives’ expectations.

- A chart of accounts is a list in your business’s general ledger; it’s a crucial part of keeping your company’s financial transactions organized.

- NetSuite’s powerful reporting makes it easy to produce any kind of financial statement or to provide a snapshot of your financial performance.

- In your liability accounts, you’ll see all your short, medium, and long-term loans, and interest payable on those loans.

- Join our advisor community and get your practice featured on our directory.

- Click the “Add New Account” link next to the account type you want to add .

- If you’re setting up your Chart of Accounts manually, be sure to leave a lot of room between accounts to add new accounts.

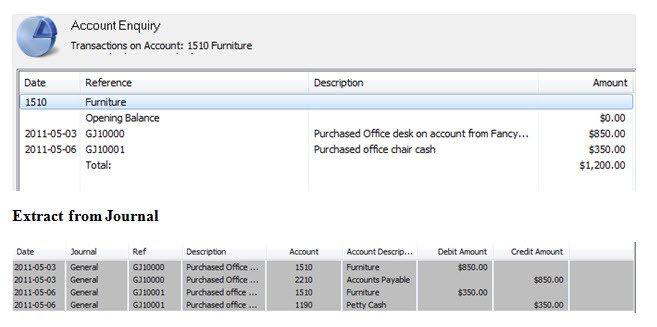

Write-off Expense – the expense account that you use when cancelling or writing off an account. Please Note – You can delete only the accounts that have never been used, i.e. they have been not linked to any product and there have been no manual journal entries entered for them. The changes will be reflected in all transactions which occurred before and after editing the account. Usage is whether this will be a Header or a Detail Account in your financial reports. The sample Chart of Accounts, shown, was developed using QuickBooks. \nThe sample Chart of Accounts, shown, was developed using QuickBooks.

What Is a Chart of Accounts?

How To Setup Your Chart Of Accounts accounts usually begin with reference number 3. CoA replaces the filing cabinets of yore where back offices had intricate paper indexing systems for their transactions. So if you’re looking to make sure you’re following all the best practices for your CoA, you’re in the right place.

Building some level of detail into the chart of accounts is a practical way to ensure key information is always in the face of the management team. Some of the components of the owner’s equity accounts include common stock, preferred stock, and retained earnings. The numbering system of the owner’s equity account for a large company can continue from the liability accounts and start from 3000 to 3999.